Leading Debt Consultant Singapore: Expert Services for Debt Resolution

Leading Debt Consultant Singapore: Expert Services for Debt Resolution

Blog Article

Explore the Comprehensive Solutions Used by Financial Debt Consultant Services to Assist People and Family Members Achieve Financial obligation Healing Success

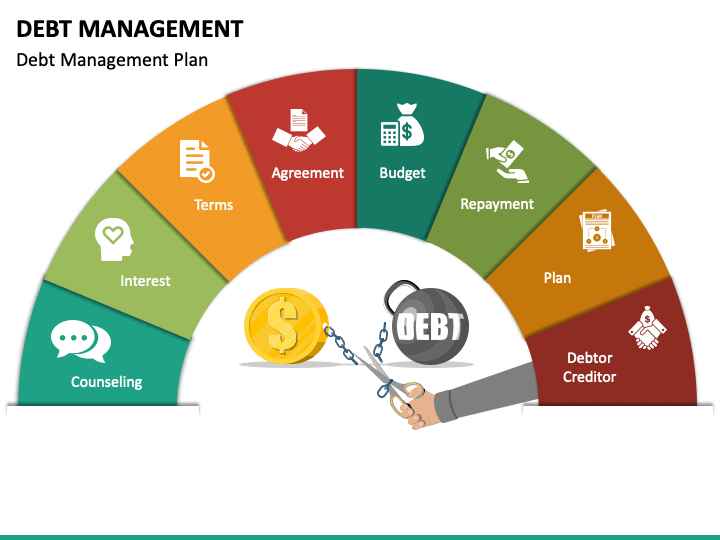

The economic landscape for people and families coming to grips with financial debt can be complicated, yet financial debt professional solutions provide an organized method to browse this complexity. By using personalized economic assessments, customized budgeting techniques, and proficient lender settlement strategies, these services satisfy unique scenarios and obstacles. Additionally, customers take advantage of ongoing support and academic resources that equip them to keep long-term financial health and wellness. As we check out the complex services offered by these professionals, it ends up being crucial to take into consideration just how they can change a difficult financial predicament right into a workable recovery strategy.

Recognizing Debt Expert Services

Financial debt specialist solutions play a crucial function in aiding individuals and organizations browse the intricacies of financial responsibilities. These solutions give expert support and support customized to the one-of-a-kind financial situations of clients. By examining the overall monetary landscape, financial debt consultants can identify the underlying issues adding to financial debt accumulation, such as high-interest rates, poor budgeting, or unforeseen costs.

A crucial feature of financial debt professionals is to enlighten customers concerning their choices for handling and minimizing financial obligation. This might include discussing with creditors to secure more favorable terms or exploring financial debt combination approaches to simplify payments. In addition, consultants encourage customers with the understanding required to make enlightened economic choices, promoting a deeper understanding of debt monitoring concepts.

The knowledge offered by debt professionals prolongs beyond simple financial obligation reduction; they additionally play a necessary function in developing sustainable financial techniques. By instilling self-control and advertising accountable spending routines, these specialists assist clients develop a solid foundation for future financial security. Ultimately, financial debt specialist solutions work as a crucial resource for people and businesses looking for to gain back control over their financial health and wellness and achieve long lasting debt recuperation success.

Personalized Financial Evaluations

An extensive understanding of a customer's financial circumstance is essential to reliable debt monitoring, and individualized economic assessments go to the core of this process (contact us now). These analyses provide a detailed review of a person's or family's monetary landscape, incorporating income, properties, expenses, and obligations. By analyzing these essential elements, financial obligation professionals can identify the unique challenges and chances that each client faces

Throughout a personalized financial assessment, specialists take part in thorough discussions with clients to collect pertinent information about their monetary actions, goals, and issues. This information is then analyzed to produce a clear photo of the client's current financial health. The process frequently entails examining costs practices, identifying unneeded expenses, and figuring out the effect of existing debts on overall economic stability.

Moreover, personalized economic evaluations enable consultants to determine possible areas for improvement and establish practical monetary goals. By tailoring their strategy to every client's certain conditions, debt professionals can create actionable strategies that align with the customer's goals. Ultimately, these evaluations work as an important starting factor for effective financial debt recovery, preparing for notified decision-making and sustainable economic management.

Custom-made Budgeting Strategies

Reliable financial management rest on the execution of personalized budgeting approaches that accommodate private requirements and situations. These methods are important for individuals and families striving to gain back control over their financial circumstances. A one-size-fits-all strategy frequently fails, as everyone's monetary landscape is one-of-a-kind, influenced by income, costs, financial debts, and personal goals.

Financial obligation professional services play a critical function in creating customized budgeting strategies. Initially, specialists carry out detailed assessments to identify earnings sources and categorize costs, comparing discretionary and necessary investing. This makes it possible for customers to pinpoint areas where they can minimize expenses and designate even more funds towards financial obligation settlement.

In enhancement, tailored budgeting approaches include practical economic objectives, aiding customers established attainable targets. These goals foster a sense of accountability and inspiration, critical for keeping dedication to the budget plan. Continuous support and periodic reviews ensure that the budgeting approach continues to be appropriate, adapting to any changes in economic scenarios or personal priorities.

Ultimately, tailored budgeting methods equip households and individuals to take aggressive actions toward financial debt healing, laying a solid structure for long-term monetary stability and success.

Creditor Arrangement Strategies

Bargaining with financial institutions can substantially ease monetary concerns and lead the way for even more workable repayment strategies. Efficient creditor arrangement methods can equip households and individuals to attain considerable debt alleviation without turning to bankruptcy.

One basic method is to plainly comprehend the financial scenario before initiating call. This includes collecting all relevant details regarding financial debts, rates of interest, and repayment histories. debt consultant services singapore With this information, the debtor can provide an engaging situation for negotiation, highlighting their desire to pay back while stressing the challenges they encounter.

Another approach involves suggesting a sensible settlement plan. Supplying a lump-sum payment for a minimized complete balance can be attracting creditors. Additionally, recommending lower regular monthly settlements with extended terms may aid ease capital issues.

Furthermore, preserving a calm and respectful temperament during settlements can cultivate a participating atmosphere. When approached with professionalism and trust and politeness., lenders are more most likely to consider proposals.

Continuous Support and Resources

Continuous support and resources play a critical duty in helping individuals browse their financial recovery trip post-negotiation. After successfully negotiating with creditors, clients frequently require additional guidance to maintain their newly recovered economic security. Financial debt expert solutions use constant support through numerous methods, ensuring that people stay on the right track toward achieving their economic objectives.

Furthermore, many financial debt professionals use customized follow-up consultations, permitting customers to obtain and discuss ongoing obstacles customized guidance. This continuous connection helps customers remain inspired and answerable as they function towards long-lasting monetary healing.

In addition, access to online devices and resources, such as budgeting applications and credit report surveillance solutions, boosts clients' capacity to handle their financial resources successfully - contact us now. By incorporating education and learning, tailored support, and sensible tools, financial debt consultant solutions encourage families and individuals to accomplish and sustain long lasting financial healing

Final Thought

Via personalized monetary evaluations, personalized budgeting techniques, and expert creditor arrangement techniques, these solutions efficiently attend to one-of-a-kind monetary obstacles. The detailed remedies supplied by financial debt professionals inevitably foster financial stability and accountable spending routines, paving the way for an extra secure financial future.

Report this page